Grangemouth

Grangemouth

Grangemouth

Grangemouth

Grangemouth oil refinery officially closes after 100 years in operation. Photo credit: yahoo

Grangemouth Refinery Halts Operations: Transition to Import Hub, Calls for Policy Reform, and Strategic Implications for Scotland's Energy Sector.

The end of crude oil processing at Scotland’s Grangemouth refinery marks a pivotal moment for the nation’s industrial and energy landscape. Petroineos, a joint venture between INEOS and PetroChina (CNPC), confirmed in late April 2025 that the site would transition from refining to serving as an import terminal for finished fuels, following sustained financial losses and mounting competition from larger, more efficient refineries abroad. This closure brings an end to more than 70 years of refining at Grangemouth, with the loss of around 400 jobs and significant concern for the local community, which has long depended on the site for stable employment and economic security

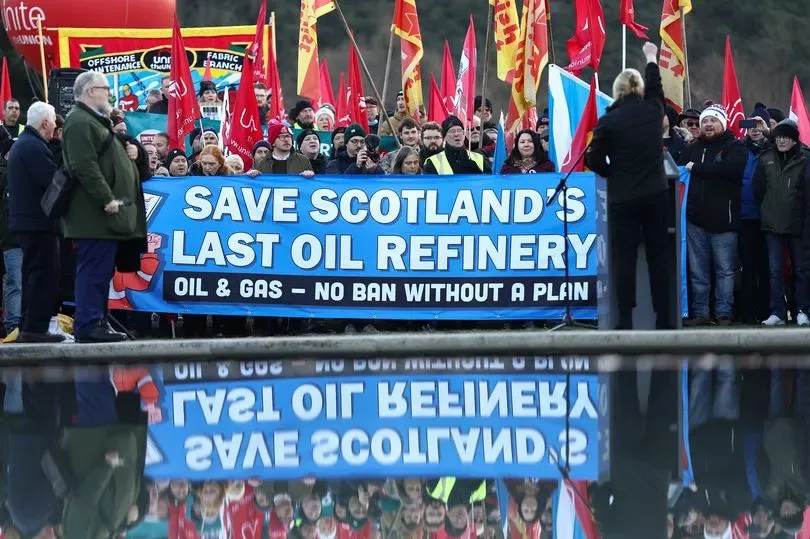

The decision has been met with regret and frustration by many in Scotland, including the Scottish Government, which described the closure as premature and detrimental to both the economy and the country’s transition to net zero. Workers and unions have voiced deep concerns about the lack of consultation and the adequacy of transition plans, fearing a repeat of the economic decline seen in other former industrial communities. While some government support for retraining and local investment has been pledged, the loss of Grangemouth’s refining capacity is widely seen as a blow to the region’s industrial fabric and a test of policymakers’ commitment to managing the energy transition responsibly.

Against this backdrop, INEOS Chairman Sir Jim Ratcliffe has been outspoken in his criticism of the UK’s energy and environmental policies. Ratcliffe argues that high energy costs and carbon taxes-particularly those imposed under the UK Emissions Trading Scheme (ETS)-are “squeezing the life out of” British industry and making it uncompetitive globally. INEOS faces a £15 million bill for carbon emissions at Grangemouth for 2024 alone, a cost Ratcliffe says is forcing the company to pause critical investments in green projects and efficiency upgrades. He warns that such policies risk accelerating deindustrialization, citing energy bills that are 400% higher than those in the US and double the European average. “This is not just INEOS; this is a reality for British manufacturers across the nation: carbon taxes and soaring energy costs are suffocating the industry,” Ratcliffe said. He has called for a fundamental rethink of the UK’s approach, urging, “Give us competitive energy costs, give us the incentives to invest in new assets and to play our part in building a strong sustainable industrial future,” emphasizing the need for entrepreneurial freedom and lower taxes to allow the energy sector to function and invest in decarbonization.

Strategically, the closure of Grangemouth means Scotland will now import all of its motor fuels, relying entirely on international supply chains to meet domestic demand. This shift increases exposure to global market fluctuations and supply risks, reducing the country’s energy self-sufficiency. While Petroineos has emphasized that the new import terminal will safeguard fuel supply for Scotland, the loss of domestic refining capacity leaves the nation more vulnerable to external shocks and diminishes its leverage in shaping fuel standards and supply terms. In effect, Scotland’s energy security and industrial autonomy have been significantly lowered, underscoring the far-reaching consequences of the Grangemouth closure for both the local community and the wider Scottish economy.

#petroineos #grangemouth #refinery #refining #ineos #cnpc #petrochina #plantclosure #carbontax #energytransition #netzero #ratcliffe